What tech companies have to say in the digital transformation of the new normal

Digital transformation has become a hot topic worldwide in every industry alike.

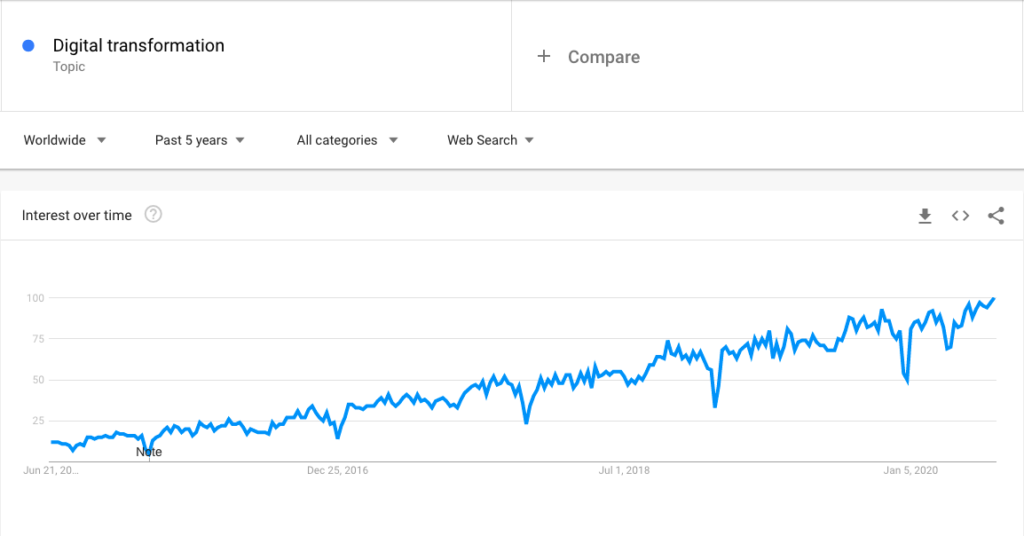

The recent events related to COVID-19 have accelerated the urge of boosting digital transformation. Just out of curiosity, before digging into the article I did a quick search on “Digital Transformation” in Google Trends to see the evolution of the general interest in the last five years, which has been rising, specially in the last months. Not surprised though, but interesting nonetheless.

According to McKinsey, we have vaulted five years forward in consumer and business digital adoption in a matter of around eight weeks and this trend is here to stay in the the post-COVID-19 recovery. This crisis has stated the importance of digital adoption to guarantee business continuity and the recovery won’t be different. That’s why now, more than ever, businesses need to put digital transformation at the core of their continuity plans and invest in appropriate technologies to succeed into the new ways of working.

Respondents identified ways in which existing resilience plans fell short, and noted gaps in how to address technology. “Firms that had a mature were better positioned to handle the shift. In some cases, had to fill in the gaps for a variety of tasks”, it states the report, which also mentions some difficulties in managing network access to guarantee .

Technology investment: increased spending on cloud technology; digitisation of client experience, from onboarding to servicing; smart use of tools to improve the agility of response, communication, and reporting during an event; and investments to support more updated business impact analysis data.

Future of work, to incorporate the new ways of working emerged during the crisis.

Redesign of controls. Financial services realised that many processes were still done manually. They aim to improve workflow tools so they are digitalised, adapted to function with a remote workforce.

In the same line, EY has established some collateral challenges highlighted by the pandemic that should be improved post COVID 19, all of which can be properly addressed by the support of the existing tech ecosystem.

Operational and infrastructure inefficiencies in the collateral life cycle have been exposed due to volatile market conditions. Firms with a reliance on manual processes and fragmented infrastructure, have lacked the ability to analyse and effectively predict their inventory and obligations, resulting in missed margin calls and suboptimal collateral allocations.

Opportunities for transformation must be analysed strategically as there is no one-size-fits-all model. Firms should invest in their front-office trading and optimisation infrastructure and review whether they should invest in further uplifting operational capabilities.

Firms should review their ability to design an operating model that meets their strategic goals. It is encouraged that firms take advantage of the vulnerabilities exposed by the pandemic, in order to drive financial resource efficiency in the upcoming regulatory reform that will increase volume and complexity.

The good news is that the technology ecosystem is full of firms who already have these capabilities integrated into their products and solutions. Financial services organisations can’t afford not to transform the lessons learnt from the crisis into action plans.

Digital transformation has become mandatory

John Doe Tweet

The time to boost the digital transformation of the financial services is now, and it’s important that everybody understands the real meaning and implications when we talk about digital transformation. As perfectly and concisely explained by Dr. Dobrica Savić in this paper: From Digitization, through Digitalization, to Digital Transformation, it is much more than digitizations and digitalization, it’s part of a company mindset. It’s a change of a company’s culture, the way it works and thinks.

Start your digital transformation journey now. There is no one-size-fits-all model, every company it’s different, but they can’t rely on manual processes, especially if regulated. There is too much to lose and the risks of fines, reputation and failure are too high.

Prepare for remote working as a sustainable and long term solution. The crisis arrived all of the sudden, without giving much time to prepare. But by now you should have a good overview of what worked and what’s needed to improve. If done properly, remote working can be very efficient, but you need to have o have a strategy in place and to implement tools to manage teams and processes digitally, to make sure that it is done securely, and in compliance with rules and regulations.

Decision making mechanisms in companies will be permanently changed. Think about board meetings, shareholder meetings and committee meetings. Now that these meetings could no longer be held physically, the finding was that the digital alternative was frequently more efficient and just as effective. In fact, we believe that virtual meetings are the most sustainable solution beyond coronavirus for these main reasons:

Everyone has easy access to information so they can prepare well before the meeting.

Meetings are shorter and more focussed around agendas and outcomes, so they are much more cost efficient.

Decisions are recorded immediately, so there is a better tracking of decisions and actions.

And since there are less displacements to get to meetings, the CO2 footprint of meetings is also much lower.

TLDR: